Inherited ira tax calculator

Ad Build Your Future With a Firm that has 85 Years of Retirement Experience. By Christy Bieber Updated Jun 29 2022 at 1254PM.

Credit Scores 101 Understand Exactly What Goes Into The Calculation With This Easy Visual And Get Step By Step I Credit Score Fico Credit Score Fix My Credit

Many other plans including 457 plans or inherited employer-sponsored plans for designated beneficiaries can also be rolled over.

. These rules dont apply if youve simply transferred another IRA to your own IRA but are. Inherited IRAs - if your IRA or retirement plan account was inherited from the original owner. Reduce beginning life expectancy by 1 for each subsequent year.

The inherited IRA 10-year rule refers to how those assets are handled once the IRA changes hands. 2020 designated beneficiaries of retirement accounts and IRAs calculate RMDs using the Single Life Table Table I Appendix B Publication 590-B. Spouses non-spouses and entities such as trusts estates or charities.

Use our Inherited IRA calculator to find out if when and how much you may need to take depending on your age. When an IRA owner passes away the account is passed on to the named beneficiary. Ad Compare 2022s Best Gold Investment from Top Providers.

If you inherit IRA assets from someone other than your spouse you have several options. Ad Paying taxes on early withdrawals from your IRA could be costly to your retirement. Reviews Trusted by Over 45000000.

1920 to 2022 What is your date of birth. IRAs and inherited IRAs are tax-deferred accounts. This Inherited IRA Distribution Calculator is intended to serve as an informational tool only and should not be construed as legal investment or tax advice.

Inherited IRA Taxes If you inherit an IRA you need to know the tax rules. Use oldest age of multiple beneficiaries. Discover The Answers You Need Here.

You can also explore your IRA beneficiary withdrawal options based on your circumstances. Ad Inherited an IRA. 1 to 12 Day.

Determine beneficiarys age at year-end following year of owners death. If you simply want to withdraw all of your inherited money right now and pay taxes you can. An inherited IRA is an account opened to distribute the assets of a deceased owner of an individual retirement account IRA or employer-sponsored plan to the beneficiary or beneficiaries.

Make sure that any IRA withdrawals you do make are above the annual required minimum distribution RMD. Youll have to pay taxes on any distributions taken out of the account at current income tax rates. An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today.

We recommend consulting with your tax or financial advisor as these new rules can be complex. Distribute using Table I. 1 to 31 Year.

The tax information in the calculator is not intended as a substitute for specific individualized tax legal or investment planning. Can take owners RMD for year of death. Ad Do Your Investments Align with Your Goals.

Those under the new 10-year rule may not have an annual RMD. Inherited IRA Distributions Calculator keyboard_arrow_down. Free inflation-adjusted IRA calculator to estimate growth tax savings total return and balance at retirement of Traditional Roth IRA SIMPLE and SEP IRAs.

Because the SECURE Act changed the laws regarding inherited IRAs people will generally fall under one of two rules. This Inherited IRA Distribution Calculator is intended to serve as an informational tool only and should not be construed as legal investment or tax advice. Buy Gold Investments from Top US Providers.

Transfer the assets to an inherited IRA and take RMDs. Learn More About Inherited IRAs. If you want to simply take your inherited.

What can or cannot be done with an inherited IRA and how distributions from the account are made both depend on who the beneficiary is or beneficiaries are. Enjoy Tax-Deferred Growth No Early Withdrawal Penalty When You Open An Inherited IRA. Schwab Can Help You Through The Process.

Inheritances arent taxed at the federal level so you wont face a tax bill just from inheriting an IRA. You should discuss your situation with your investment planner tax advisor or an estate planning professional before acting on the information you receive from the Inherited IRA. Reviews Trusted by Over 45000000.

The rules for inherited IRA taxes vary based on how you. Cash on Hand. But if you want to stretch the IRA proceeds and.

You should discuss your situation with your investment planner tax advisor or an estate planning professional before acting on the information you receive from the Inherited IRA. Find a Dedicated Financial Advisor Now. There are no taxes due when rolling over company.

If you inherited an IRA such as a traditional rollover IRA SEP IRA SIMPLE IRA then the rules around RMDs fall into 3 categories. If you take those distributions before you reach the age of 595 youll likely have to pay a 10 early withdrawal penalty fee to the IRS. If youve inherited an IRA andor other types of retirement accounts the IRS may require you to withdraw a minimum amount of money each year also known as a Required Minimum Distribution RMD.

Make a Thoughtful Decision For Your Retirement. When you are the beneficiary of a retirement plan specific IRS rules regulate the minimum withdrawals you must take. That means that tax is paid when the holder of an IRA account or the beneficiary takes distributionsin the case of an inherited.

As a nonspouse beneficiary if you decide to transfer inherited IRA assets from the original owners IRA to an inherited IRA in your name the assets do not get to stay in your inherited IRA account. With an Inherited IRA you may either need to take annual distributions no matter what age you are when you open the account or may be required to fully distribute the assets in the account within a specified number of years. If you dont take the RMDs from your account you will be subject to a penalty equal to 50 of the amount that should have been withdrawn.

Inherited IRA withdrawal rules. Use younger of 1 beneficiarys age or 2 owners age at birthday in year of death. The tax rules for inherited IRAs.

Motley Fool Asset Management. Paying taxes on early distributions from your IRA could be costly to your retirement. Those under the old rules may be required to take RMDs from inherited IRAs.

To report the excise tax you may have to file Form 5329 Additional Taxes on Qualified Plans. Calculate your earnings and more.

Inherited Ira Taxes Who Pays How Much Do They Pay

Rmd Calculators Required Minimum Distributions Charles Schwab Required Minimum Distribution Inherited Ira Financial Planner

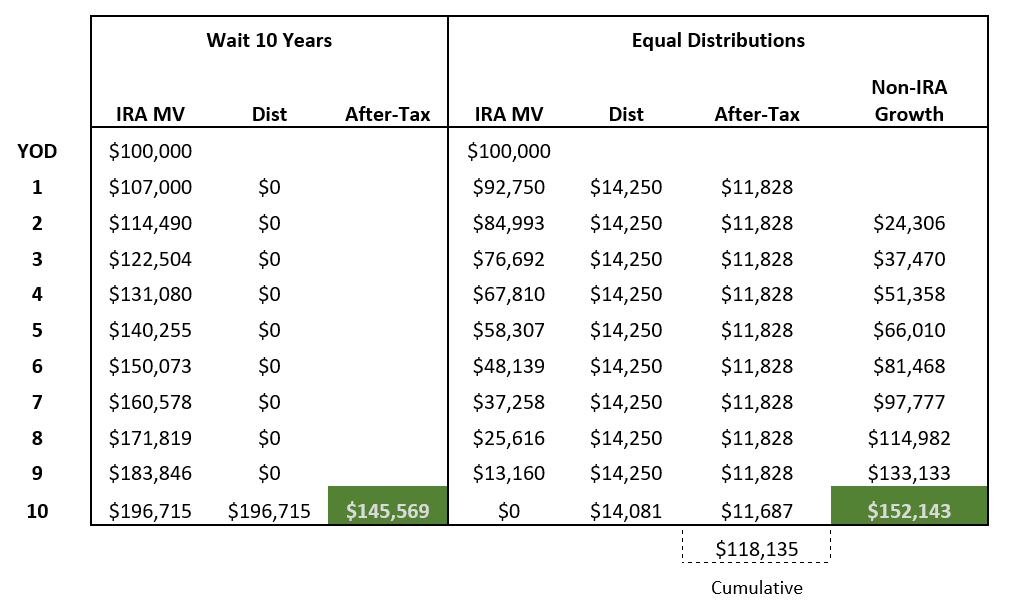

Understanding The Secure Act Managing The 10 Year Rule Financial Planning Insights Manning Napier

Canadian Foreign Tax Credit On Ira Distribution

Inherited Ira Taxes Who Pays How Much Do They Pay

Ira Calculator

The Ird Deduction Inherited Ira Beneficiaries Often Miss

Podcast Podcasts Dad Life Favorite Books

/ira-5bfc2faa4cedfd0026c1d618.jpg)

Can The Non Spouse Beneficiary Of An Ira Name A Successor Beneficiary

Irs Proposes Updated Rmd Life Expectancy Tables For 2021 Life Expectancy Proposal Irs

Capital Gain Tax In The State Of Utah What You Need To Know Capital Gains Tax Capital Gain Education Savings Account

The Mega Roth An Interesting Twist For Super Savers Under The Proposed New Secure Act Tax Free Savings Retirement Money Savers

Pin By Bree Johnson On Money Saving Tips Finance Lessons Budgeting Money Financial Peace University

Net Worth Scenario Tool Positive Numbers Negative Numbers Net Worth

Pin On Personal Finance

Self Employed Here Are 5 Retirement Savings Options For You The Motley Fool Saving For Retirement Investing For Retirement The Motley Fool

Irs Wants To Change The Inherited Ira Distribution Rules